child tax credit october payments

For qualifying children claimed. Eligible families and individuals could.

Stimulus Update Here S When To Expect October Child Tax Credit Payment Al Com

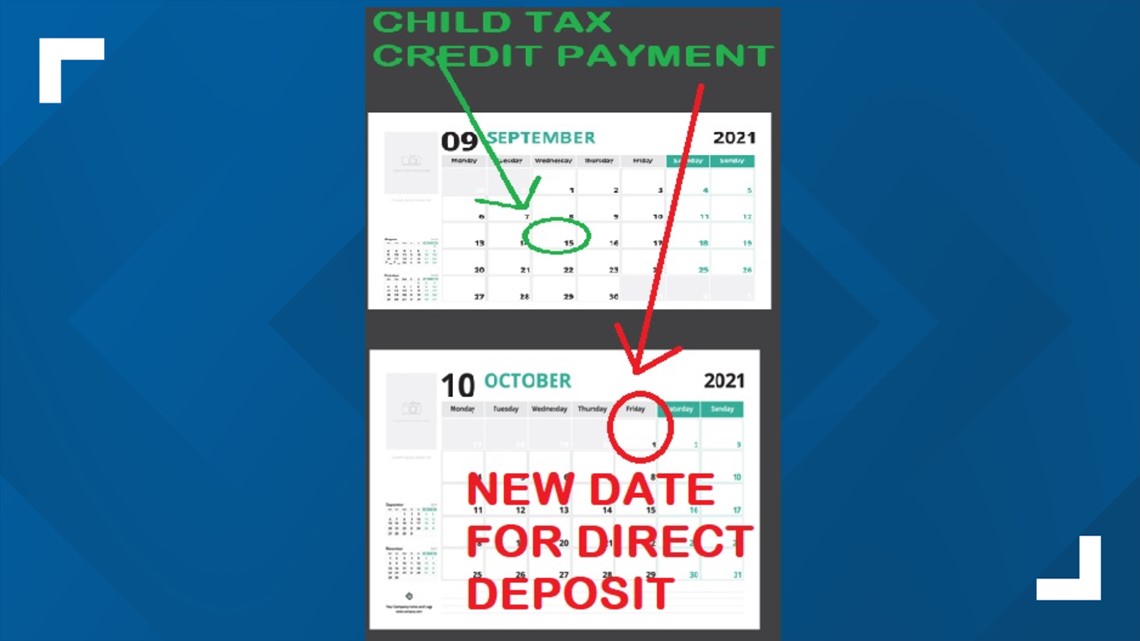

October 14 2021 559 PM CBS Detroit.

. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. 1200 sent in April 2020. The Child Tax Credit is a tax benefit to help families who are raising children.

Everything you need to know. Youll need to print and mail the completed Form 3911 from. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

IR-2021-201 October 15 2021. Couples making less than 150000 and single parents also called Head. Here is some important information to understand about this years Child Tax Credit.

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Households receiving tax credits will start to receive the 324 payment from. Nearly all families with kids will qualify.

Again you want to wait until you see the actual direct deposit or the check in. Free means free and IRS e-file is included. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6.

Guaranteed maximum tax refund. At first glance the steps to request a payment trace can look daunting. Child Tax Credit Dates.

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Ad Free tax filing for simple and complex returns. Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Next payment coming on October 15. You receive your check by mail not direct deposit.

Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and. If you are supposed to receive your Child Tax Credit payment by mail but it hasnt arrived yet your payment may be delayed. Check mailed to a foreign address.

For example the maximum monthly payment for a family that received its first payment in October is 500-per-child for kids ages 6 through 17 and 600-per-child for kids. The actual time the check arrives depends. Next payment coming on October 15.

The ongoing advance monthly payments for the child tax credit are also scheduled to arrive Oct. 1200 in April 2020. Child Tax Credit Dates.

The payment amount is calculated based on an individuals family situation in October 2022 and on their 2021 tax and benefit return. Enhanced child tax credit. Goods and services tax harmonized sales tax GSTHST credit.

Wait 5 working days from the payment date to contact us. Includes related provincial and territorial programs. 600 in December 2020January 2021.

The Child Tax Credit provides money to support American families. That depends on your household income and family size. CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. 2 days agoThis is to avoid duplicate payments where people claim tax credits and another qualifying benefit. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October.

Max refund is guaranteed and 100 accurate.

Child Tax Credit There S A New Stimulus Payment Arriving This Week Here S How Much Families Will Get The Us Sun

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Individuals Recently Separated Or Divorced Stripped Of Stimulus And Advanced Child Tax Credit Payments Lone Star Legal Aid

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Can A Government Shutdown Affect Child Tax Credit Payments As Usa

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

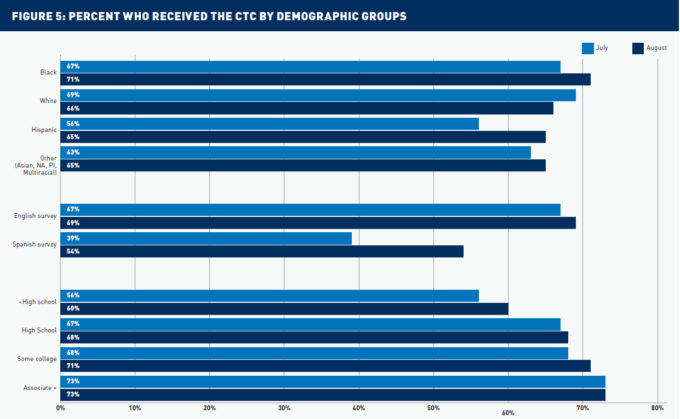

Child Tax Credit Providing Critical Help But Not Reaching More Than 1 In 10 Eligible Families

Stimulus Update Was Your October Child Tax Credit Payment Lower Than Expected This Could Be Why

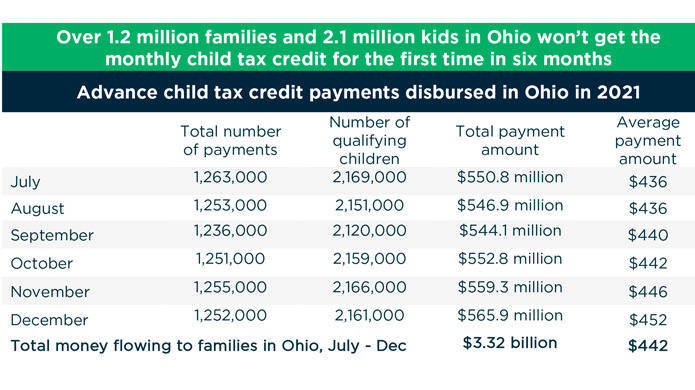

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Child Tax Credit Schedule How Many More Payments Are To Come Marca

Some New Yorkers Will Get An Unexpected Payment When They Check Their Mail In The Coming Weeks

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

What Is The Child Tax Credit Tax Policy Center

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities